Lesson 2 - Value of Money - Part 9

Next we will look at some different savings plan. It is best to make this in Excel or some other similar program. We often need to do some adjusting to the plan. We have created one for you to use, Click here to View and Download

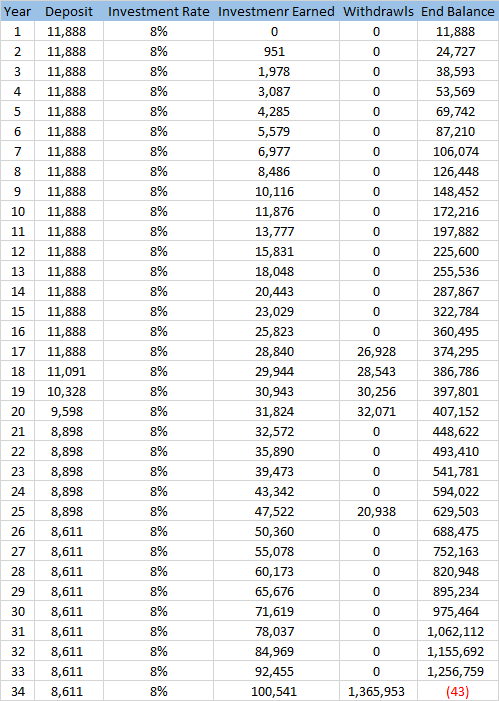

Our Savings Plan can be vied as a success, if all our savings Goals are met and we have an End Balance very close to 0. It might be a few dollars off due to rounding of our numbers.

In this example of our savings plan, we use the full amount of savings necessary to achieve our Goals. At year 17 of the plan we must pay for the 1st year of Education. Some important things happen here, we have a withdrawal from the savings in the amount of $26,928 at the end of the year. Starting the next year “18” we no longer need to save for that 1st year of education. Our total payments into the savings plan went from $11,888 to $11,091. If we look back at the Goal Spreadsheet we see that we no longer need to save the $798 dollars.

As the rest of the Education is met, each year we will begin savings a little less, because we no longer have the savings need. By year “25” we are going to take our vacation and again withdrawal from the plan at the end of the year “$20,938.” Starting in the next year “26” we no longer need to save for this Goal either, and our savings need drops down to $8,611.

Though this plan is the easiest plan available, it doesn’t always work out. Again we might not have the $11,888 dollars in the first few years until we start earning more in our careers.

Comments

Please Join or Login to Join the Conversation